2022 Three Key Trends of China Agrochemical Industry

Dear friends,

Thank you for your time and attention. Today I would like to present 2022 three key trends of China agrochemical industry for you.

As you may know, it is 14th Five Year Plan from 2021 to 2025. There will be big upgrading for China industries, not only for the fine chemical industry but for every key industry in China. As for the Agrochemical industry, I listed three key points.

First of all, it is double control and environmental protection. We all knew that the double control policy impacted China's agrochemical production from September 2021. It brought a quick shortage of raw material for Glyphosate due to the electricity shortage in the southwest of China. The suspension of production also brought the rocket high price and limited supply. At that time, some of my global friends considered the Double Control policy will be a replay of the environmental protection storm of 2017. And a lot of global sourcing managers felt scared about their supply chain management by the end of 2021.

But from December 8th to 10th, China's annual Central Economic Work conference released an important optimistic signal. This signal makes the industry generally feel relaxed because the central government is trying to optimize the double control policy to maintain the routine industry operation. It mentioned that “Renewable energy and raw material energy, which is for production (not for fuel or power), are not included in the total energy consumption control”. I also mentioned it in my latest article for ABG. If you show interest, you can check the details on the Agribusiness Global website.

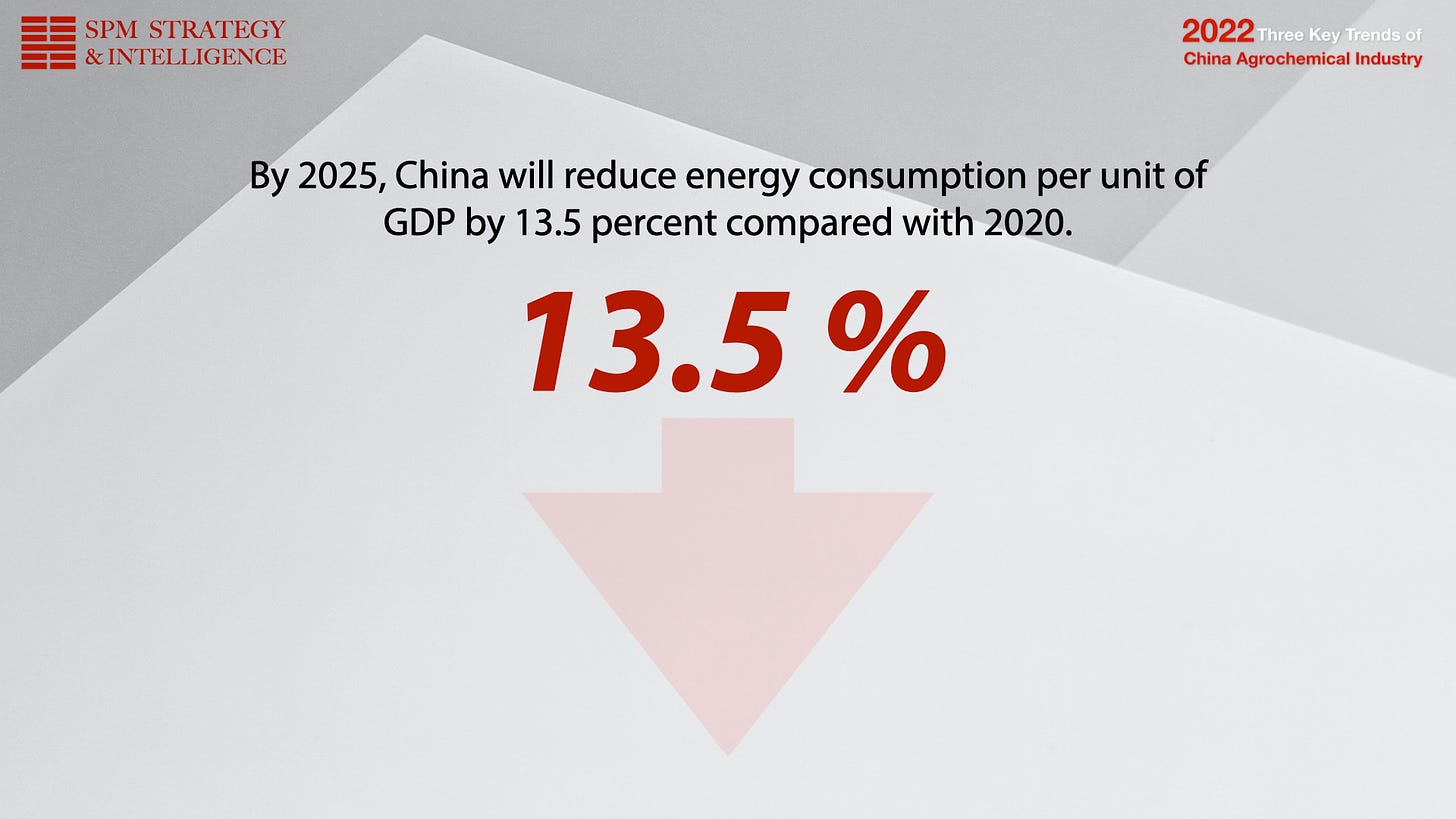

For China's 14th Five Year plan, there will be a clear number target. By 2025, China will reduce energy consumption per unit of GDP by 13.5 percent compared with 2020. For such a clear goal, we will see the continuous optimization, the optimization of energy consumption in industry park, optimization of energy consumption in logistics together with environmental protection.

As for the optimization of energy consumption, the most efficient way is to manage industry parks’ consumption. In the 13th Five Year plan, China had already started to guide the agrochemical producer to move into industry park. It was mainly for the control of waste emission. In 14th Five Year plan, 100% of newly built chemical pesticide and biological pesticide production enterprises will enter the chemical park or industrial park. For industry parks, they will increase the utility of renewable energy. It could be a more efficient way to have higher adoption of renewable energy.

Moreover, China is also trying to optimization of logistics. The key logistic facilities in China will focus on energy saving. And the big data application will also drive more saving of energy consumption by higher efficient logistic management. The key ports like Tianjin, Dalian, and Shanghai will adopt high automatic tools to enhance efficiency, especially during the COVID19 impact. The China ports have to maintain ordinary operations meanwhile they also have to protect the workers.

Even the Omicron pandemic hit Tianjin, it did not stop the operation of Tianjin ports. Some media of logistics made the wrong information without double-checking. If we do not make direct research, we could make the very wrong decision on China sourcing. So It is very important to have a China source to have double confirmation.

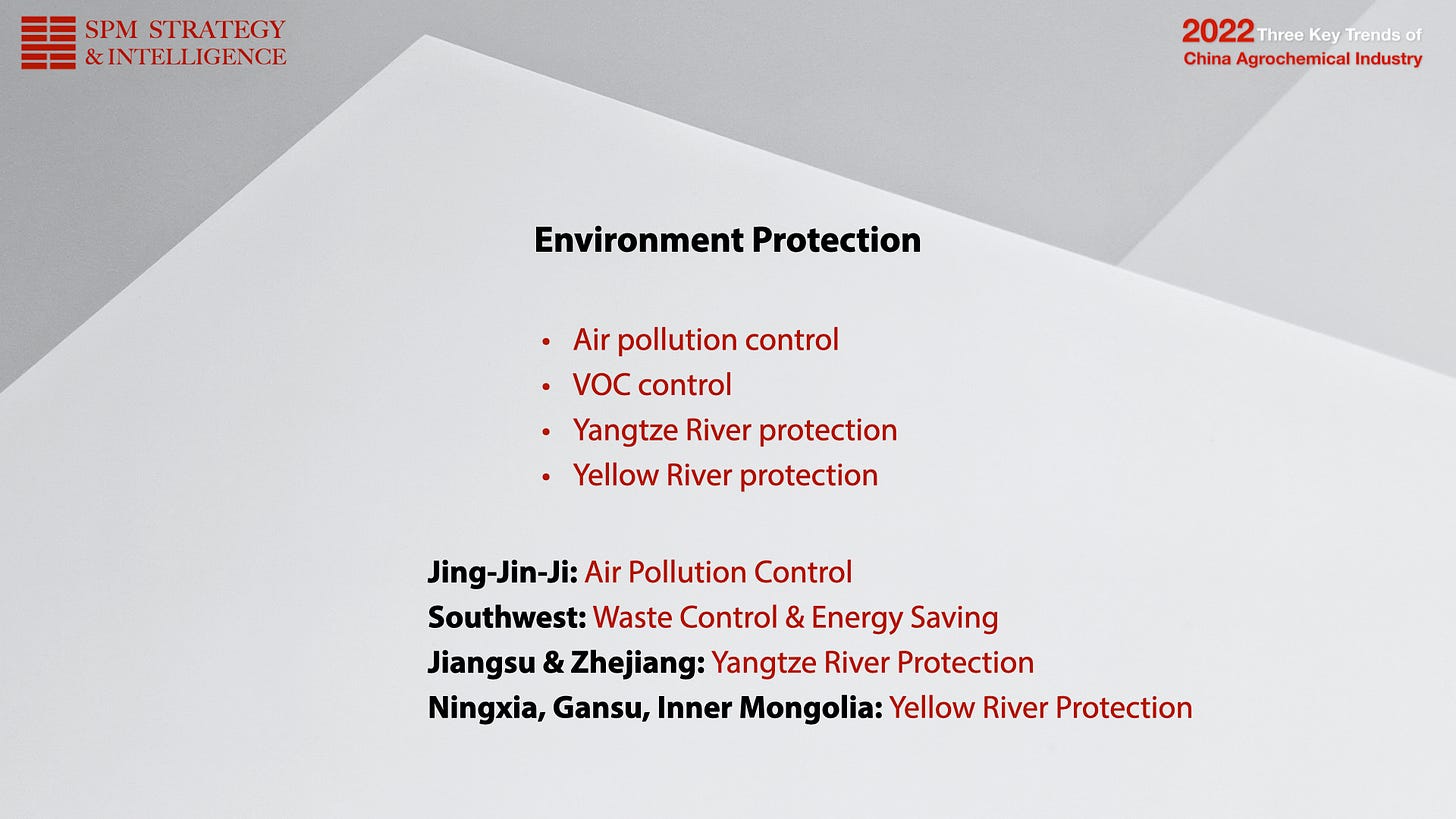

Environment protection is still a hot topic. Air pollution control is mainly for the Jing-Jin-Ji area. It will consistently influence the production in Hebei, Shandong, Shaanxi area, Inner Mongolia. The VOC control will be always a critical parameter for Agrochemical plants. The law of Yangtze river protection had already been launched in China. It is mainly for the production management in the south of China, like Jiangsu, Zhejiang areas, etc.

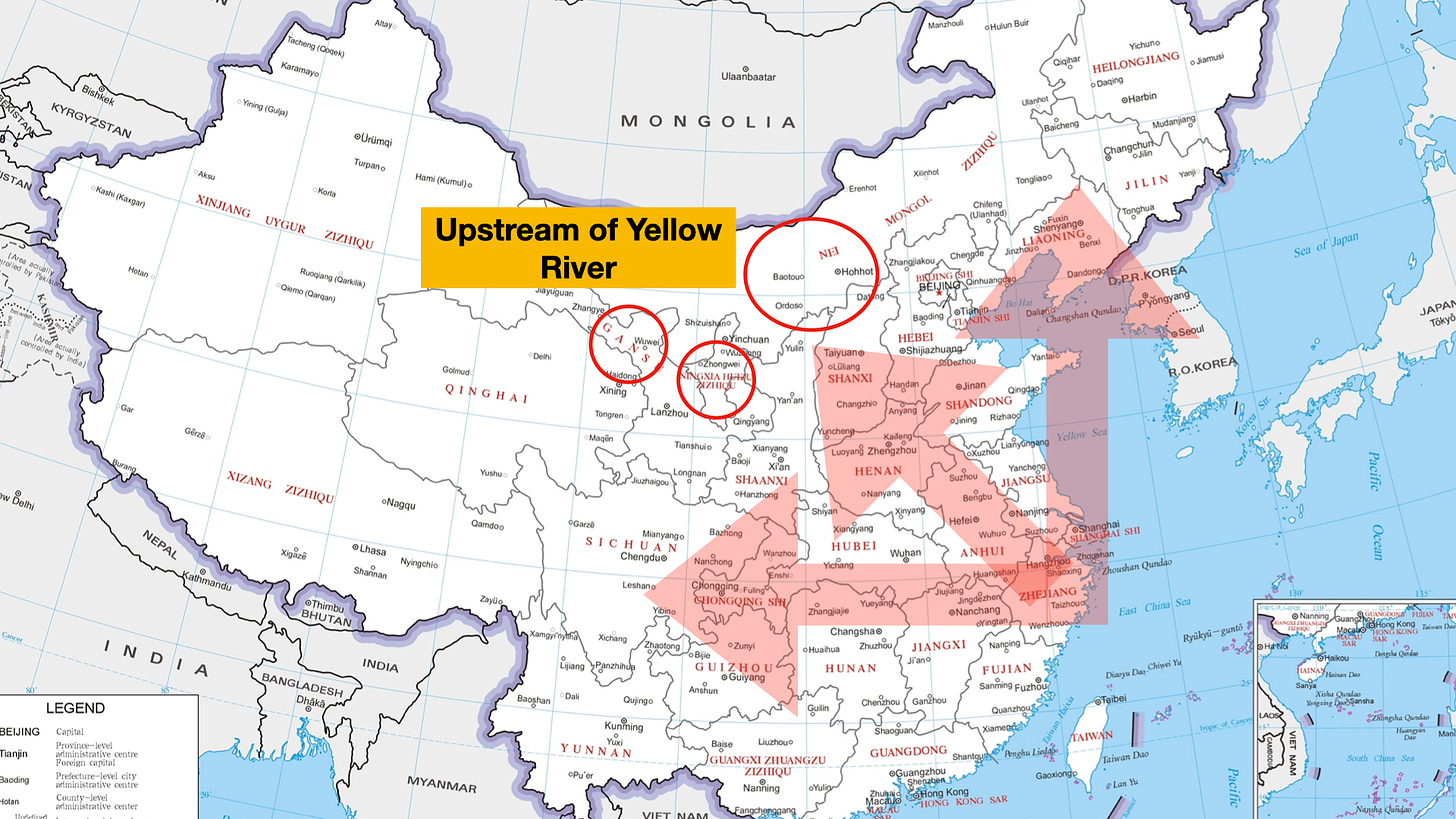

There will be an important issue, the Yellow river protection in these five years. Since 2017, there was a trend for China's agrochemical industry that is moving to the northwest. Some capacity is rising from Sichuan province like Lier, Fuhua, etc. And some capacity moved to the North. Cynda moved their capacity to the Liaoning area where they have Dalian port and fine chemical cluster in Dalian area. And Sichuan and Liaoning both have industry workers because of China's historical reasons. So they all have competitive advantages.

But the Ningxia, Gansu, and Inner Mongolia capacities will face big challenges. First, they need to train industry workers. It is very difficult to train north China people. The second challenge will be the Yellow River protection. Ningxia, Gansu, and Inner Mongolia are upstream of the Yellow River. The Yellow river protection law will focus on the protection of ecology. Water and vegetation will be very important for the ecology and as the water source of people. The emission of waste from the plants in such areas will be strictly controlled.

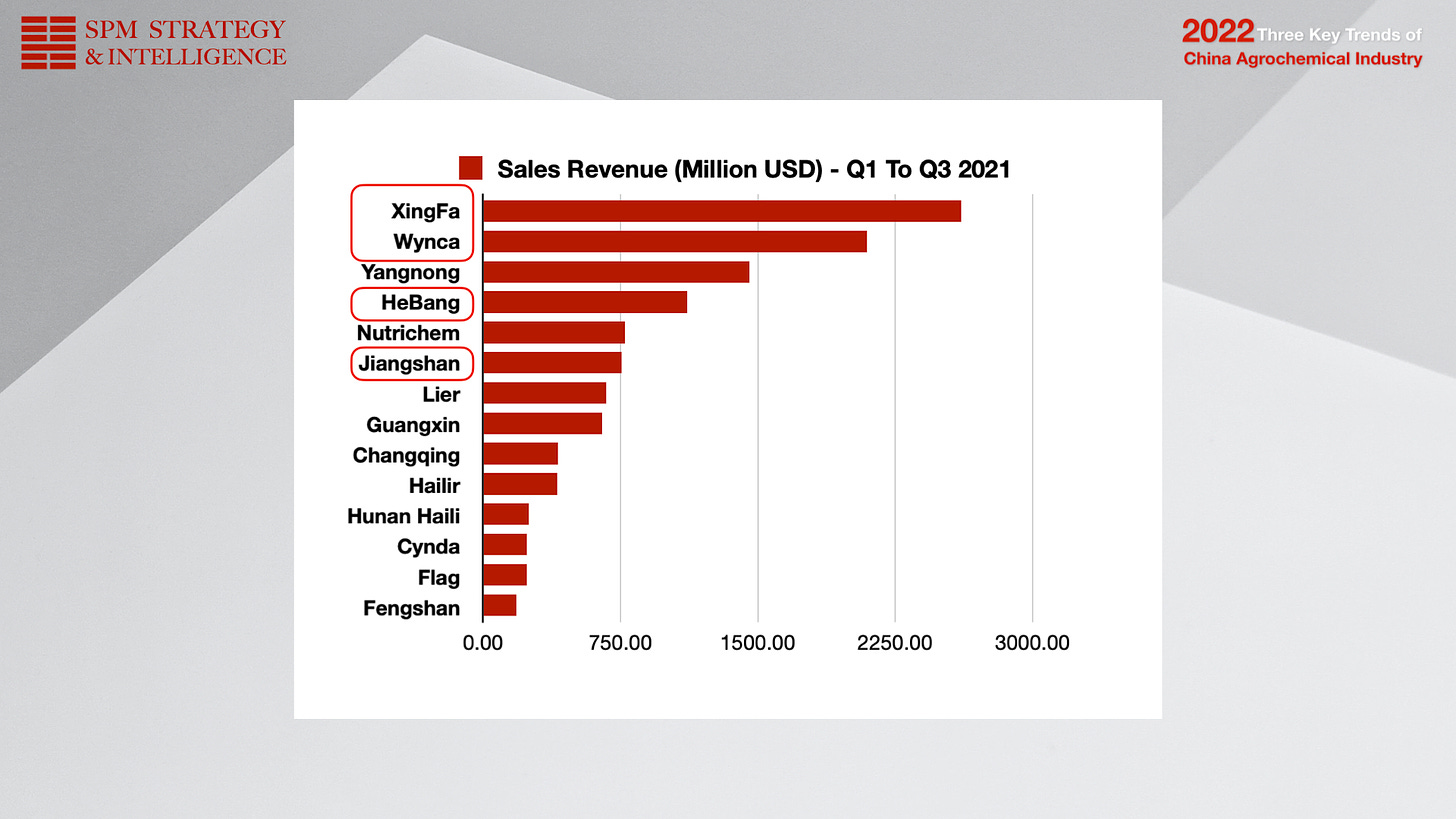

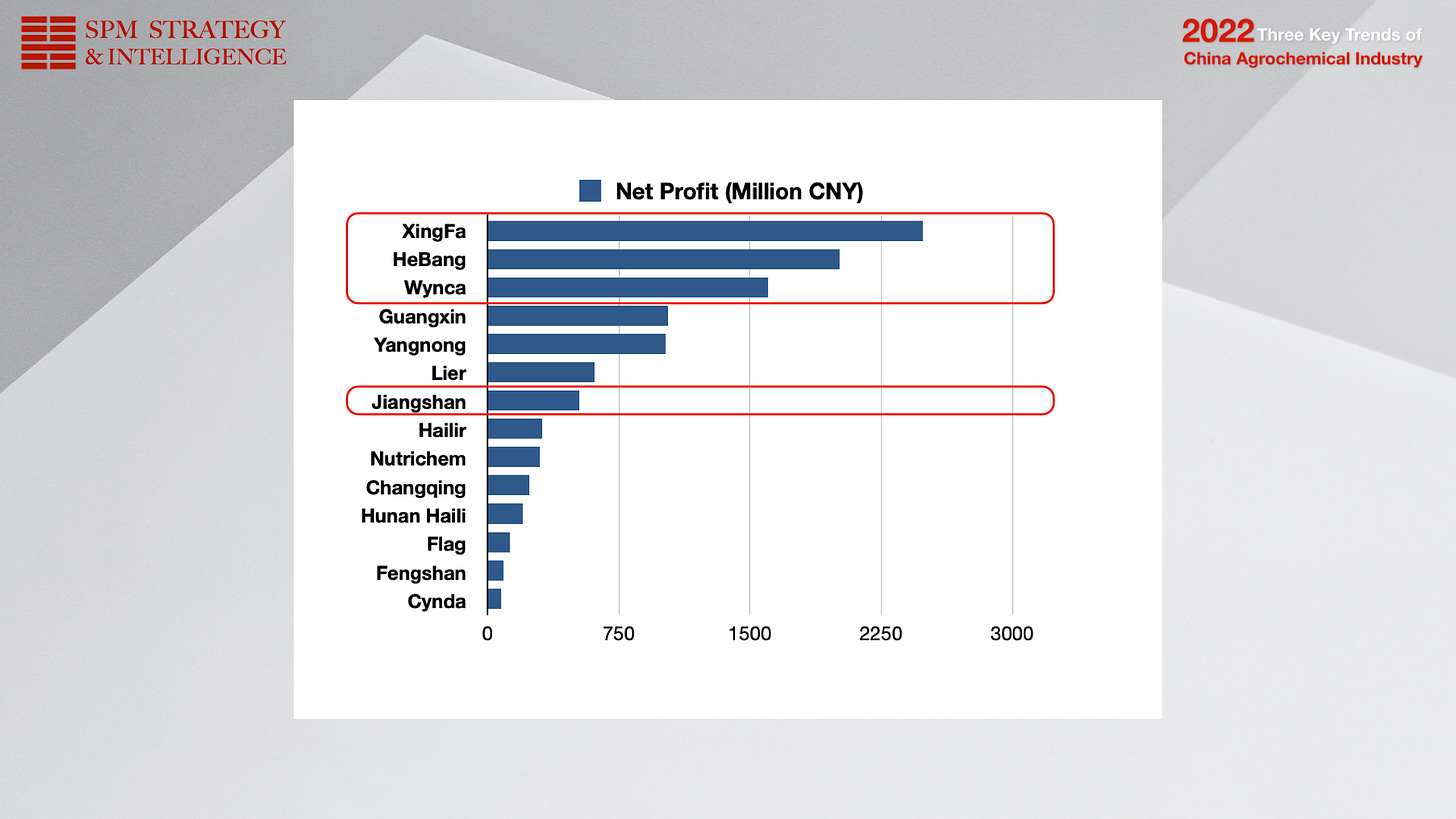

The 2nd trend is the consolidation of China's agrochemical industry. I used to mention in my article that only 20% of China agrochemical companies will supply around 80% of agrochemicals of world demand. According to the Q3 financing reports of China stock-listed agrochemical companies, Glyphosate producers all had good financing performance due to the high volume sales and high glyphosate price. Xingfa, Wynca, Hebang, and Jiangshan all had good performance, high sales reveneue and high net profit.

I prefer to ignore the Glyphosate producers’ performance firstly. And let us check the details of the others. Besides Glyphosate producers, Yangnong, Nutrichem, and Lier had good sales performance from Q1-Q3. But considering the net profit, Guangxin, Yangnong Lier are the top three.

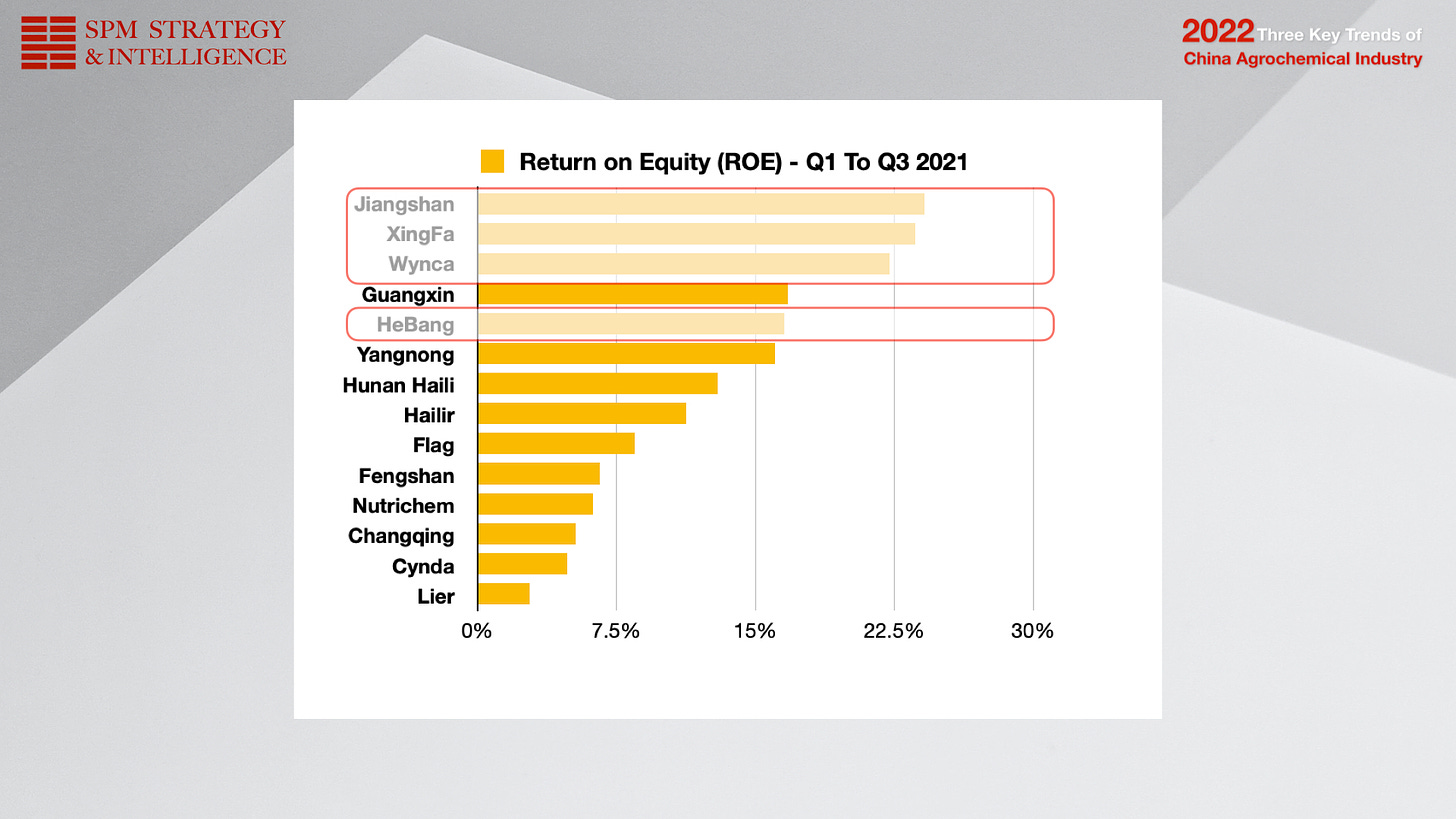

From a financing point of view, we always prefer to review the return of equity, the ROE. Guangxin, Yangnong, and Haili are the top three which had better ROE from Q1 to Q3. Guangxin and Haili have carbonyl chloride resources which is a very critical raw material for agrochemical production. Yangnong is focusing on the full value chain from upstream to downstream. As the key AI manufacturing center of Syngenta Group, Yangnong had a strong pipeline of AI. And they also utilize other alliance companies to extend their reach to board customers. According to the ROE, Hailir and Flag Chem were trying their best on investment of new projects. Hailir expanded its portfolio from Imidacloprid to prothioconazole. Flag chem is developing into deep diversity, the agrochemical business, new materials, and life science.

In contrast, other companies performed poorly. Cynda and Lier’s ROE are very low among stock-listed companies. It was mainly because of the accident that happened in their production plant. The accidence dragged their supply growth and increased the cost of operation compared with their market capitalization.

So the good management of production safety would be very important for the company’s healthy growth.

Nutrichem had good sales but a lower net profit. It could be because of their heavy investment in R&D. And their B2B marketing strategy became more stable due to the stable purchasing contracts from their key partners. New investment and new molecules shall be very important for Nutrichem in the future.

Overviewing the total China agrochemical industry, the new consolidation could happen between Wynca and Nutrichem in 2022. In the middle of 2021, Nutrichem and Wynca signed the official strategical cooperation agreement. In Q3 2021, Wynca intended to invest 800 million yuan (around 126 million USD) to receive 12.31% of Nutrichem shares held by Huapont. After the completion of the transfer, Wynca became the second-largest shareholder of Nutrichem.

So what’s the future of Wynca and Nutrichem? Wynca, as the leading Glyphosate producer, had a good net profit in the 2021 season. And Nutrichem has a competitive advantage in R&D and global cooperation. Wynca was trying its best to become a diverse company, not only focusing on Glyphosate. They merged Xingyu with selective herbicide portfolios. The future M&A between Wynca and Nutrichem would be highly possible, which would bring new giant manufacturers in China agrochemical industry.

The 3rd trend in China agrochemical industry shall be innovation. The patent AIs developed by Chinese manufacturers will be much more than before. In the global market, we all know that Japanese companies invested a lot in patent AIs in past twenty years. But China is investing more than before to search for new molecules. And China also has advantages in the life science industry which also helps China to have more advantages on future biological portfolio discovery.

CAC Nantong signed an agreement with Syngenta Group China for their patent molecule, Cyproflanilide strategic cooperation in 2020. In 14th Five Year, CAC Nantong will also launch other new molecules. So it just showed us an example. Along with more investment in R&D, China agrochemical companies will have more competitive advantages on patent molecule development. The reason why China still does not have many patent molecules, that’s because China started late. So that I have a positive point of view for China agrochemical future.

Dr. Yousheng Duan, Assistant Secretary-General of CCPIA, gave me several points of China agrochemical industry innovation. High tech production process is the key innovation for China's agrochemical industry. That’s because there will be no additional capacity for long-tail portfolios, like Glyphosate, 2,4-D, Imidacloprid, etc. Only the novel production process can lower the cost of production, achieve energy saving and lower the emission of waste. Chinese manufacturers had already achieved the environmental protection goals. For energy-saving and carbon neutrality, they are the new requirements, and manufacturers still need time to find out a good solution. And China manufacturers are using micro-channel, micro interfaces, and tubular reactors to have continuous reaction management. The more efficient catalysts are another pathway of innovation. The novel catalyst can increase the utilization of atoms which increases the yield of a chemical reaction. The industrialized asymmetric synthesis reaction will be used more in the coming five years. Chinese chemistry scientists still have a lot of room to improve.

That’s all, we called three key trends of China agrochemical industry in 2022. And the Chinese Spring Festival is coming. Please have my best wishes to all my global friends. I hope you all have great success in Chinese Tiger Year.