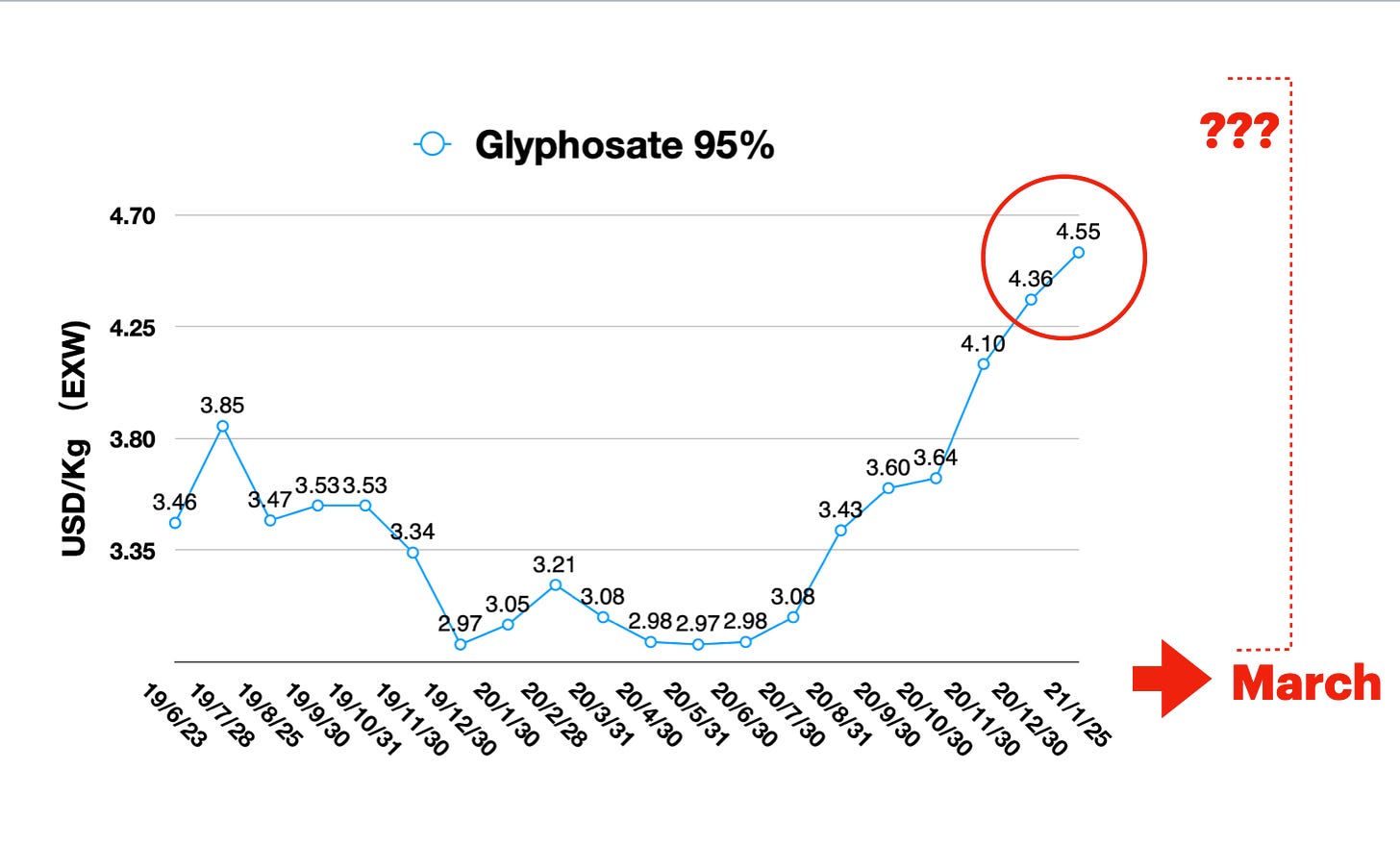

Update 25th Jan - Glyphosate Price Rocket Up to March?

Pandemic of COVID19 in Hebei province brought shortage on the intermediate of Glyphosate AI

Up to 60% of Glycine suppliers of China are located in Hebei Province and Shandong Province. And 34% of China Glycine capacity is in Hebei where the pandemic of COVID19 is under control by the local government.

Till this week, the unpredictable pandemic was obviously affecting the operation of Glycine manufacturing. Most of the people in Hebei Province are staying at home for many weeks from the beginning of Jan 2021. Normally the people’s lockdown can be back to normal after 14 days when the last case of COVID19 recovers. However, there are still more than 800 positive cases of COVID19 in the hospital. The not clear timeline shows us when the Hebei could become normal.

The sudden impact on Glycine supply broke the balance of demand from Glyphosate manufacturers. Jiangshan and Fuhua Group have around 150 thousand Mt as PMIDA route Glyphosate capacity. Since Fuhua has its own PMIDA as the complete set of Glyphosate upstream. So they could have more competitive offers than other competitors.

The demand for Glyphosate Active Ingredient (AI) is still strong. According to key suppliers, the futures contracts are jammed till March 2021. On 25th Jan, the latest EXW price of Glyphosate is averagely at 4.55 USD/Kg (See below chart). The strong demand for Glyphosate will be integrated together with the temporary shortage of PIMIDA in Hebei. ///For the first quarter, the Glyphosate AI price will be continuously uptrend from cautious consideration. The new offer shall be investigated after the Chinese Spring Holiday.

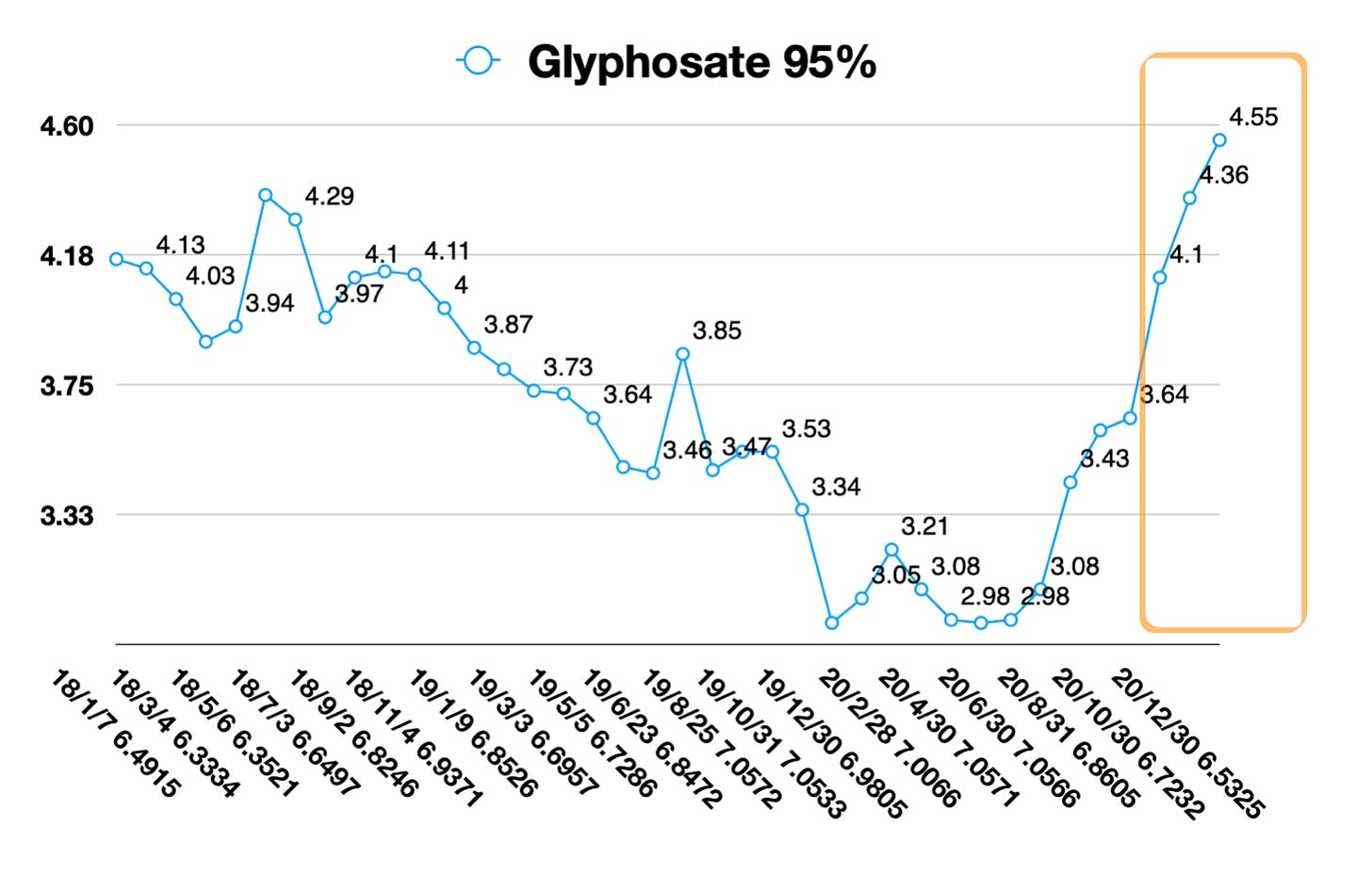

Sometimes, time can show us the reality. If we review the historical price of Glyphosate AI. It gives us an abnormal trend in 2021. Only at the beginning of 2020, we saw a soft increase in Glyphosate price. In 2018 and 2019, Glyphosate price was weaker than in 2021.

The global demand for the active ingredients and the pandemic of COVID19 overseas make the global supply chain put more weight on safe inventory for the coming season. The early demand is also possible to happen in 2021 due to the uncertainty of global shipment. The intensive contract in the first quarter could lead to an unbalance as the arising price trend.