Update 9th Mar 2022 - Take-away of practical sourcing and Glyphosate/Glufosinate price updates

If you only want to know Glyphosate and Glufosinate AI price trend, go to the bottom.

Take-Away of Practical Sourcing

It is useless to track the historical price trend when you need a “correct” strategy of purchasing. There will be always two trends for the product future price down or up, 50% vs. 50%. Like Ray Dalio posted on Linkedin, “Anything is possible. It’s the probabilities that matter. Everything must be weighed in terms of its likelihood and prioritized. People who can accurately sort probabilities from possibilities are generally strong at “practical thinking”; they’re the opposite of the “philosopher” types who tend to get lost in clouds of possibilities.”

A good sourcing team needs to have a sense of future price trends. We have to figure out the correct information from the chaos of the market. Because some information is just to attract attention as a tool of market value management. When the Glufosinate price went up in the middle of 2021, one manufacturer was arguing with me on how high the Glufosinate price can reach? To be honest, we knew the cost of Glufosinate production. The only issue was the shortage of supply in 2021. That’s the reason why I alerted the high risk of purchasing high price Glufosinate. In 2022, there is a dropping price of Glufosinate due to the increased capacity from China market. That is inevitable because “things always develop into their opposite” according to a Chinese ancient principle of Nature rules.

On the other hand, there are many potential customers of mine who want me “sell” the capability of price anticipation to them. Here is the question. If I can predict the future price, that means I can easily buy in the inventory, and sell out the cargo to earn the commission. I could be super rich by such a “superpower”. So Why do I have to provide sourcing service for the limited profit to feed my three assistants, one engineer, one team of trading in my office, three key partners in Agrochemical Industry? When Bayer CropScience announced the force majeure, my suggestion is to wait for ten days. The trading companies were pushing some Chinese procurement managers to place orders as soon as possible because the dealer worried Glyphosate price would increase a lot very quickly. At the beginning of March, the downtrend of Glyphosate AI illustrated the truth of the market.

In such chaos market, purchasing every product at its lowest cost is not the right and achievable strategy. The wisdom solution is to have a smooth supply based on cost saving target YOY. Of course, the saving cannot be kept all the time. Since the cost of purchasing cannot be zero. So what really matters? The strategy match and synergy of supply chain competitive advantage shall be the answer.

To achieve the goal, do not proceed with over-analysis. The monthly price is the balance between supply and demand. That’s it to show us the status of the supply market. However, the most important thing is to MAKE DECISIONS. It requests the sourcing team work closely to understand what you need from China, the business target, the portfolio you want to bring into the target markets, the quantity you are aiming to gain, registration requests, and the full budget of future sourcing. EU and US companies have strength in supply chain management. Because multinational companies have their internal process of sourcing. They are very clear about what they need from us. Cooperation between me and multinational company is a cycle of reaction between two parties. It can benefit both sides.

In China Agrochemical Industry, the sourcing team needs to know the history of key manufacturers, understand the upstream to downstream on key portfolios, familiar with the behavior and characteristic of their key management teams. There are some persons or bosses who cannot be cooperated. For the team we cooperate with, we need to track their behavior in the market. We always check how can this company grow up during the past decades. The persons on our black list have a high possibility to lead the project to fail. I experienced many sourcing directors being laid out of the team because of the endless delays in projects, sudden changes in cooperation strategies, and cooperation based on unreal capabilities. To be honest, your suppliers are your future career development. From my point of view, we prefer to work together with scientists boss or engineers boss. Because they know the importance of R&D investment, their team will always have the potential for growth by new portfolio development.

As I mentioned in SPM introduction, China strategy sourcing requests hard-working, frequent visits to suppliers, long conversations with the multi-level management team of producers, monitoring the industry trend, consulting with key experts in the China Agrochemical Industry, and plus the failures we made. Preparing well before the meeting with your supplier is the top priority. If you do not know the market well, how can you save the cost by a tough bargain with the Chinese, almost pretty much one of the smartest people on the planet? Of course, I do not mean that “I do not like Chinese”. On the contrary, I prefer to become an old friend of my customers in China, an old friend to offer some help and support. As a bridge between global and China, my team and I hope to make things happen easily and directly. “Get things done” is our goal.

That could be all cliche. But they are all basic principles when we manage our project. One multinational company’s staff asked me a few weeks ago. How could you source some key products in China? You know, the Chinese never trust sellers in Alibaba. We use the “Practical Intelligence + Verification” model as our key principle of supplier selection. The intelligence comes from our friends’ network, alumni network, expert network, etc. Forget about the “Guanxi” (Relationship), the word is as same old as my grandpa’s denture. In the 21st Century, relationship is old fashion. Fourteen years ago, I can deal with a 50 million USD business annually just graduated from China Agriculture University. I started without Guanxi (Relationship) at that time.

In the current market, we utilize “practical intelligence” to do analysis. Practical intelligence is the information package that can guide us to make decisions, but not sufficient. They shall be coming from our experience on more than 150 projects in the past decade. And they also need to be optimized by key expert suggestions in China Agrochemical Industry which is truly extremely valuable. When we have practical intelligence, we go for verification of the practice intelligence. It takes a lot of time but is worth doing. It is an art of interaction with suppliers. We always start from small projects to monitor the system of agrochemical suppliers, from their strategy to the characteristics. We can always have a very long-term view on the cooperation, like 20 years, 50 years or even 300 years on country development. If you take a long enough view, you can control how the world works. That’s not a joke.

So when my customer talks about cooperation with me, I always want to ask them a question. How much budget do you want to invest in China sourcing? And how long you will invest? To establish a China branch office, hire a supply chain manager with good experience, it cost around 100k USD per year just as the salary. If you need a team, the total headcount cost would be more than 200K USD per year. The world is fair, the more you invest, the more you gain. COVID19 blocks global travel, we are seeing many multinational companies are enhancing their China sourcing intelligence. Since the uncertainty of world politics and future trends, the earlier occupation of the China resources is much more competitive on the establishment of long-term competitive advantage of the supply chain.

Glyphosate/Glufosinate Price Update - The Crazy Glufosinate is coming!

The current China market inventory level is stable. Not like other “expert” comments, Beijing Winter Olympic Games did not affect ordinary production so much. Moreover, Double Control seems to no longer impact the industry. During the conflict between Russia and Ukraine, the world’s energy, crude oil, natural gas, fertilizer, and food supply will face huge uncertainty in the coming few months. The combination of war and inflation makes the future world economy impossible to predict. But surely, life goes on. If we don't have the ability to predict future lottery numbers, we should minimize or avoid the effects of war as much as we can.

The food commodity price touched the sky (See below pictures). To be straight, everything will be expensive, everything, compared with our income. The future shortage of raw material supply would increase another round of inflation. When the prices touch the moon, the demand will also decrease. The consequence had already shown up in China agrochemical industry.

Source: https://tradingeconomics.com/commodity/crude-oil

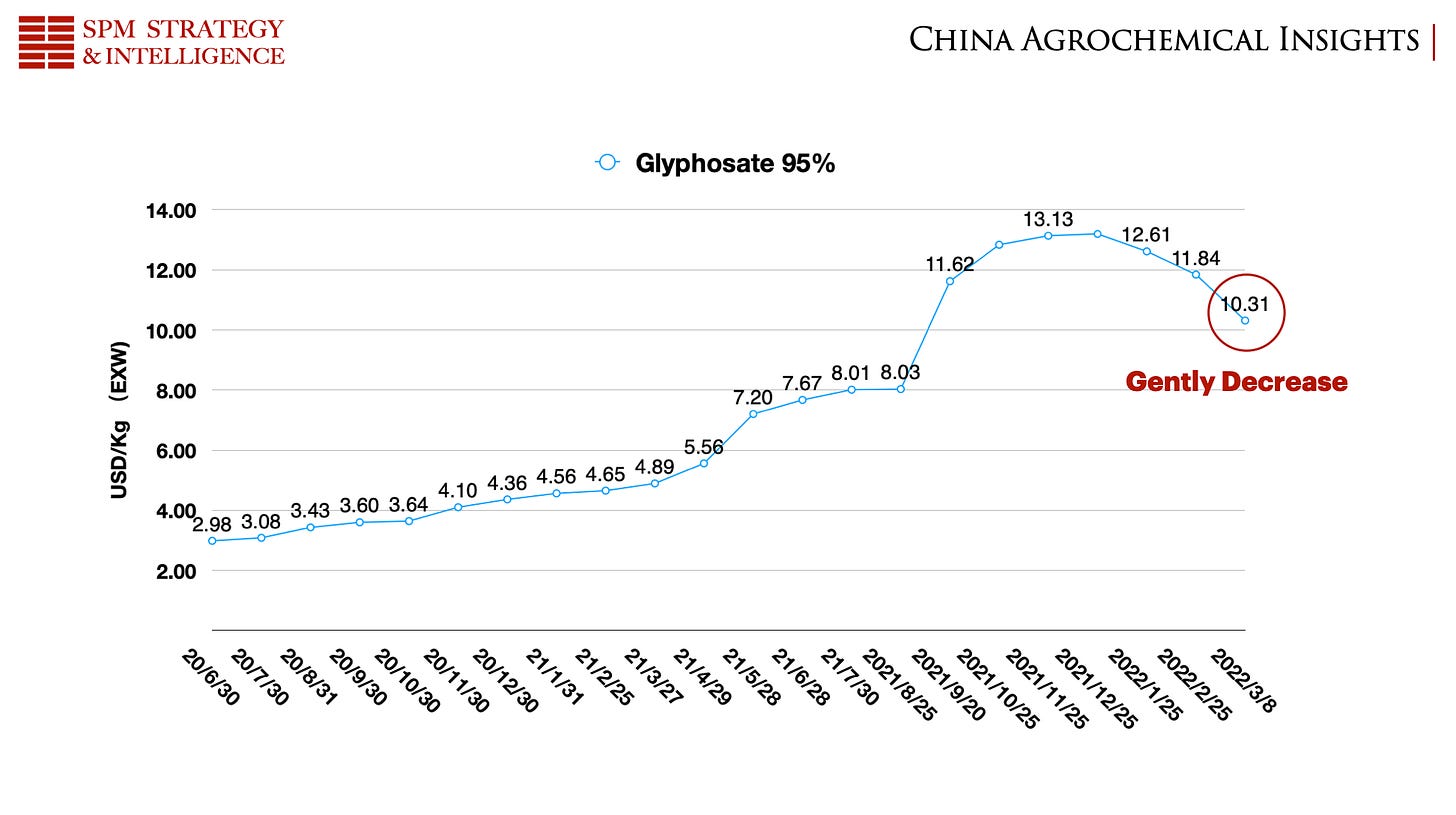

Due to the low demand from overseas, Glyphosate AI price is keeping on decreasing. The global crude oil price is hitting the global raw material market. But the impact on China's raw material market still needs time to be delivered, maybe by the end of 2022. Moreover, China has a full value chain of the Chemical industry from petrochemical to fine chemicals. The upstream manufacturers are mainly state-owned or big stock listed companies. So China is still capable to deal with such a complicated situation. East EU is one of the important customers for China agrochemical companies. The crisis of the east EU could affect the distribution channel which will cause the stable higher inventory cargo in China supply market. As the key intermediate of Glyphosate, the Glycine supply is normal with the trend of dropping. And PMIDA price is also landing softly.

Glufosinate AI is facing big pressure from new capacity and low demand from customers. The leading manufacturer of Glufosinate, Lier is producing smoothly. But some new capacity is disturbing the price in the market. The latest MUP BOTTOM PRICE of Glufosinate is EXW 17.46 USD/Kg (Exchange Rate: 6.3 CNY/USD). And the Glufosinate 95% AI price also dropped sharply down to 33.33 USD/Kg EXW in this week.

Before we “celebrate” the price dropping, we need to consider if the ultra-low price can be sustainable when we choose the partners in China. The new supplier can easily decrease the price of Glufosinate to attract attention. What if the shortage comes again in the future? The company would be the first one to increase the price sharply without a doubt. I like the lines in the movie of “King Richard”, Richard (Serena Williams’ Dad) said, “Never take anything from anybody for free, everything in this place got hooks in it”. Making the right decision is based on wisdom not only on trade-offs.

Because there will be new capacity rising by the end of 2022. The new capacity will cause an additional decrease in Glufosinate AI EXW price. The future Glufosinate price could hit down below the EXW 16 USD/Kg. Even though the downtrend of Glufosinate could make global buyers’ balance sheet a little bit tough. It would be a good thing for the expansion of Glufosinate adoption in the field. It will still be a good solution for global farmers on GM crop growing. Since the downtrend of Glufosinate price, multinational companies’ 3rd party alliance team would need to reevaluate the license-in AI strategy. The multinational generic companies’ Glufosinate AI might face the pressure of China low-cost Glufosinate in the future.